Harley Davidson Financial Analysis

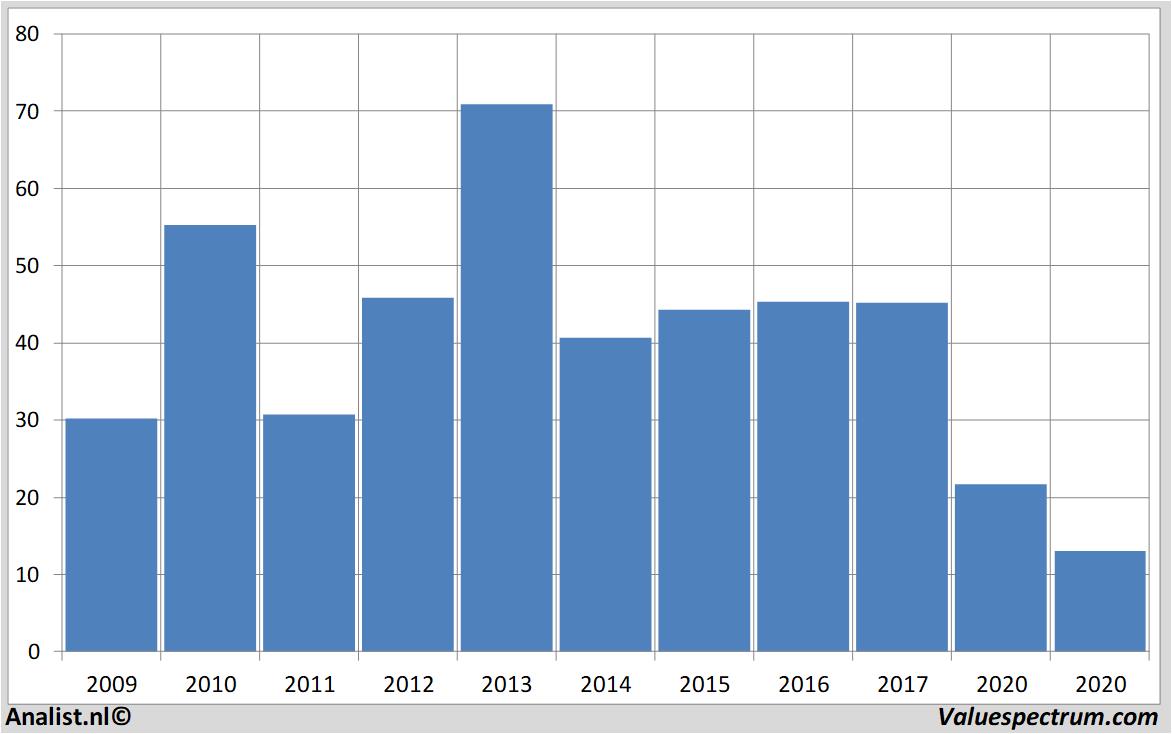

Is lower than its historical 5-year average.

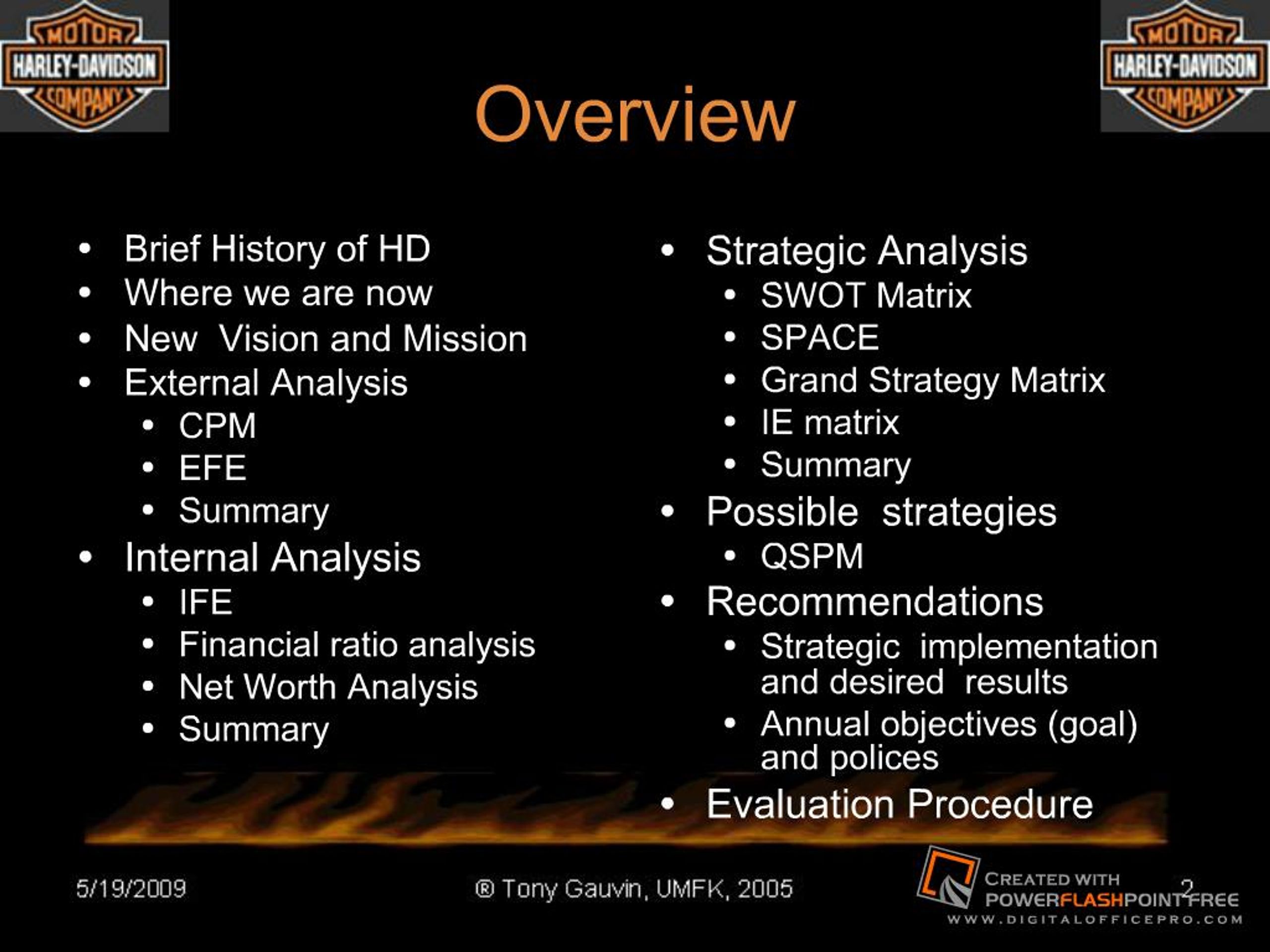

Harley davidson financial analysis. There are five lines of motorcycles manufactured by Harley Davidson which has its. Harley-Davidson designs manufactures and sells heavyweight motorcycles. This first report focuses on strategy analysis and includes the following sections.

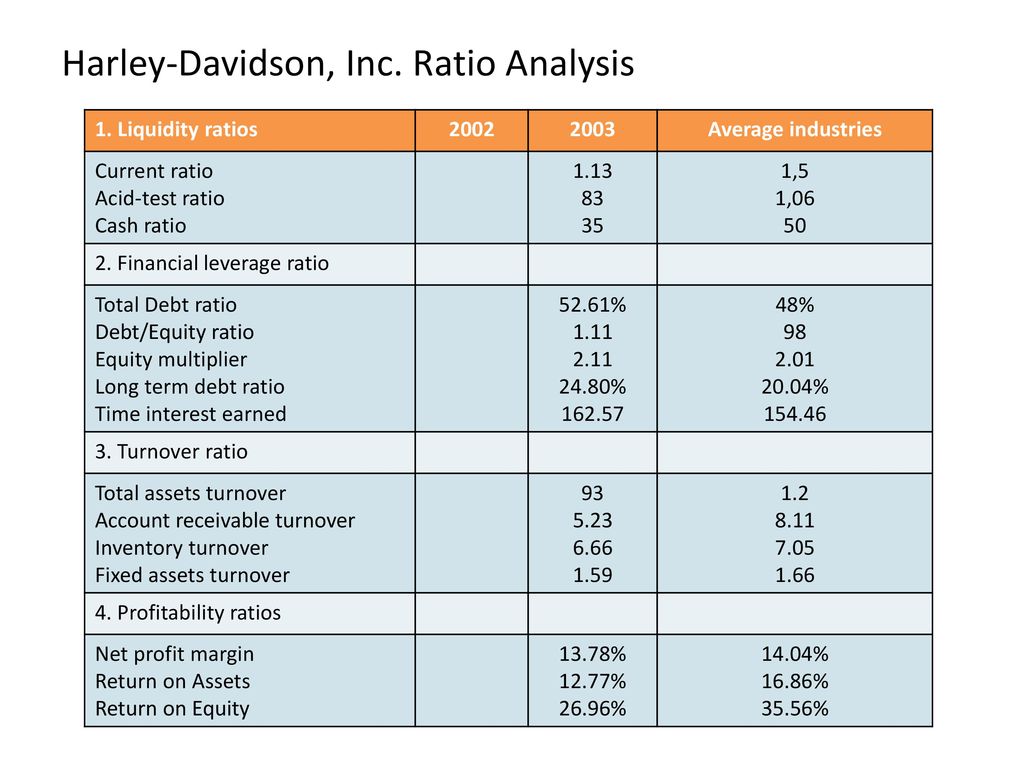

A Strategic Audit Analysis. The need to expand globally is fueled by the companys financial situation. This table contains critical financial ratios such as Price-to-Earnings PE Ratio Earnings-Per-Share EPS Return-On-Investment ROI and others based on Harley-Davidson Incs.

The net profit of the company was USD 59911 million during the fiscal year 2011 an increase of 30883 over 2010. - Financial and Strategic Analysis Review Publication Date. After reviewing the financial reports of Harley-Davidson we have come to several conclusions about the health of the company.

After peaking with 6. 2018 Harley Davidson financial analysis. Harley Davidson Strategic Analysis 1.

First we have found that Harley is a highly liquid company. Performed a ratio analysis of the financial performance of two competitors and compared them to H-D. Is significantly higher than the average of its sector Automobiles.

Harley Davidson Financial and Strategic Analysis Review 989 Words 4 Pages. Harley-DavidsonInc known for its famous bar and shield trademark is based. Harley-Davidson Financial Services Inc.